Mobile banner ads: complete guide to app monetization and revenue optimization

You’ve seen them a thousand times — slim rectangles at the top or bottom of the screen. You scroll, play, read, sometimes barely noticing them. Yet behind those quiet pixels lies a $174.4 billion market that kept apps running and publishers earning in 2024.

Banner ads didn’t chase attention; they built consistency. Compact, predictable, and everywhere, they turned ordinary user behavior into steady income through simple CPM pricing. Android publishers in the US earned about $0.68 eCPM, while iOS averaged $0.27 — roughly $2,040 per month from a single placement with 100,000 daily impressions.

To understand why this modest format is effective to this day while flashier ones came and went, we need to look closer at how banner ads work.

What are mobile banner ads?

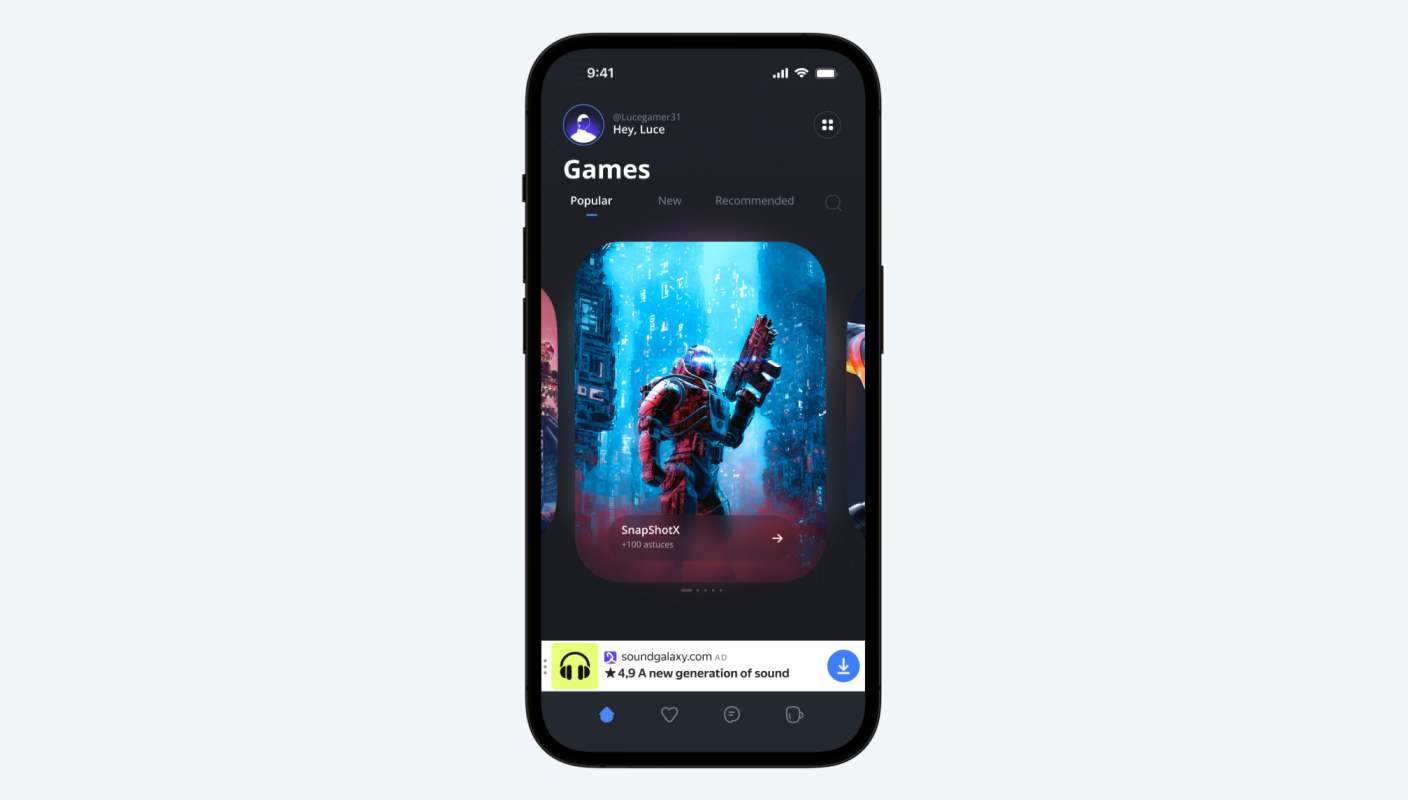

Mobile banner ads are rectangular display advertisements embedded into your app interface, occupying partial screen space between 20-250 pixels in height. Unlike full-screen interstitials or rewarded videos requiring user opt-in, banners stay persistently visible while users interact with your content – generating impressions passively without demanding action.

The format includes static images, dynamic creative, video content, and interactive elements, all conforming to IAB standards. Users don't need to click, watch, or engage; the impression counts simply by being viewable, which drives fill rates consistently above 90% compared to 60-80% for opt-in formats.

Research analyzing 270,000+ consumers confirms that mobile advertising effectiveness depends heavily on format intrusion levels – and banners score lowest on disruption while maintaining visibility. Screen coverage separates banner ads from interstitials (partial versus 100%), while the passive viewing model distinguishes them from rewarded video ads.

Banner ad format specifications

Standard banner sizes and IAB guidelines

The Interactive Advertising Bureau defines four primary banner sizes: the 320×50 leaderboard, 300×250 MREC (medium rectangle), 728×90 tablet leaderboard, and 320×100 large mobile banner. Performance data reveals MREC formats outperform standard leaderboards by 30-50% in viewability and engagement metrics.

IAB's LEAN principles – Lightweight, Encrypted, AdChoices support, and Non-invasive display – govern banner specifications. File size limits stay under 150KB to ensure fast loading, while OpenRTB protocols standardize programmatic buying across platforms.

The 300×250 MREC dominates mobile monetization because its square aspect ratio fits naturally into content feeds, article breaks, and pause screens. Gaming apps position MRECs in level selection menus, news apps embed them between paragraphs, and social platforms place them in scrolling feeds. This versatility, combined with superior visibility compared to narrow leaderboard formats, explains the revenue premium publishers capture with MREC placements.

Placement and viewability optimization

Where you position banner ads directly impacts CPM bids and revenue. Viewability – the percentage of ad pixels visible on screen for at least one second – drives programmatic auction prices, and above-the-fold placements consistently deliver 40-60% higher eCPMs than below-fold positions.

Top anchor placements work well for social apps where users start at the screen's upper edge, while bottom anchors suit gaming apps keeping gameplay controls at the top. Inline MREC placements embedded in content feeds generate strong viewability as users scroll, and floating banners maintain visibility during scrolling without obstructing content.

App category strategy matters because user attention patterns differ dramatically. Gaming sessions focus intensely on the center screen, making bottom anchors less intrusive. Content apps benefit from inline MRECs positioned every 3-4 paragraphs. Social platforms use top anchors since users scroll downward from the feed's beginning. Smart publishers A/B test placement positions while monitoring both monetization metrics and retention data.

Banner ad revenue & pricing models

eCPM benchmarks by platform and geography

Android banner ads in the US generate $0.68 eCPM in Q4 2024, while iOS delivers $0.27 – an unusual pattern where Android outperforms iOS.

The calculation is straightforward: divide total revenue by impressions, multiply by 1,000. So 100,000 daily impressions at $0.68 generates $68 daily, or $2,040 monthly from a single banner placement.

Geography dramatically impacts rates. Current mobile advertising data shows US traffic at $0.68, Canada at $0.54, and Australia at $0.51 for Android banners, while developed markets typically deliver 2-3x higher eCPMs than emerging economies.

| Region | Android eCPM | iOS eCPM | Market Tier |

| United States | $0.68 | $0.27 | Tier 1 |

| Canada | $0.54 | $0.22 | Tier 1 |

| Australia | $0.51 | $0.21 | Tier 1 |

| United Kingdom | $0.48 | $0.19 | Tier 1 |

| European Union | $0.42 | $0.17 | Tier 1 |

Seasonality adds another variable. Q4 eCPMs typically surge 20-40% as holiday advertising budgets flood the market, while Q1 often dips 15-30%. App category, user demographics, and targeting sophistication further influence rates. The platform differential reflects advertiser demand patterns – publishers focusing primarily on banner monetization should consider prioritizing Android user acquisition where feasible, as the 150% eCPM premium significantly impacts revenue projections.

CPM pricing model explained

CPM – cost per mille – represents the advertiser's perspective on banner ad pricing. While publishers track eCPM (revenue earned), advertisers monitor CPM as their cost. Programmatic platforms show banner CPMs ranging from $2.50-2.80, compared to $4.50-4.80 for interstitials and $3.00-3.30 for native ads.

Real-time bidding determines CPM through instantaneous auctions where demand-side platforms compete for individual impressions. When your app requests a banner ad, supply-side platforms initiate auctions across dozens of DSPs simultaneously, and the highest bid wins – all within 100 milliseconds.

Turn banner impressions into steady revenue

Banner vs other ad formats: a comparative analysis

Banner ads vs interstitial ads

Interstitial ads occupy 100% of screen space, appearing at natural transition points. Android interstitials generate $14.08 eCPM in the US, while iOS hits $14.32 – approximately 20x higher than banner rates, with click-through rates of 4-5% compared to banners' 0.05-0.1%. But this revenue premium comes with significant trade-offs.

Fill rates tell part of the story: banners consistently deliver 90%+ fill while interstitials range from 80-90% fill rate. User experience impact matters more – research on mobile advertising found that 90% of mobile users find certain ad formats annoying, with full-screen interruptions creating the highest frustration levels.

| Metric | Banner Ads | Interstitial Ads | Rewarded Video | Native Ads |

| Screen Coverage | 20-250px | Full screen | Full screen | In-feed |

| US eCPM (Android) | $0.68 | $14.08 | $12-16 | $3.00-3.30 |

| CTR Range | 0.05-0.1% | 4-5% | Opt-in based | 0.5-1% |

| Fill Rate | 90%+ | 80-90% | 60-80% | 85-90% |

| UX Impact | Low | High | Medium (opt-in) | Low |

| Best Use Case | Continuous baseline | Transition points | Engaged users | Content integration |

Smart publishers implement hybrid strategies: banners provide consistent baseline revenue across all sessions, while interstitials monetize high-value moments. A gaming app with 10,000 daily active users might generate $200 daily from continuous banner placements, plus $400 from strategically timed interstitials – combining formats multiplies total revenue without relying solely on disruptive high-eCPM formats.

Sources:

- Appodeal Q4 2024 data via MAF: Mobile Ads eCPM Report

- Udonis eCPM Analysis: eCPMs for Rewarded Video, Interstitial & Banner Ads

- Adapty Interstitial Study: Interstitial Ads in Mobile Apps

- WiFi Talents Display Stats: Display Advertising Statistics 2025

- Taylor & Francis Research: Mobile Technology and Advertising

Banner ads in multi-format ecosystem

Rewarded video ads deliver $10-50 eCPMs (averaging $16 for Android and 19 for iOS in the US) with completion rates above 80% because users voluntarily opt in for tangible benefits. Native ads generate $3.00-3.30 eCPMs – approximately 20% more than banners.

Banner ads function as your monetization foundation because they don't require engagement. Fill rate differentials reveal why banners anchor hybrid strategies. When rewarded video inventory fills 60-80% of requests, banners fill 90%+ consistently, so you capture revenue from every session. The combination – banners everywhere, premium formats where users engage – maximizes total revenue rather than optimizing individual impression value.

Combine formats. Maximize revenue.

How programmatic advertising powers banner ads

Real-time bidding infrastructure

Programmatic advertising reached $595 billion globally in 2024, with projections hitting $800 billion by 2028. This automated system replaced manual insertion orders with algorithmic auctions completing in under 100 milliseconds.

The ecosystem connects through three core components: demand-side platforms (DSPs) enable advertisers to buy inventory programmatically, supply-side platforms (SSPs) help publishers sell inventory efficiently, and ad exchanges run the actual auctions. When a user opens your app and triggers a banner request, your SSP sends that opportunity to the exchange, which simultaneously queries dozens of DSPs. Each DSP evaluates the impression and submits bids within milliseconds. The highest bid wins, the ad serves, and you earn revenue.

Real-time bidding determines pricing through competition rather than predetermined rates. Instead of negotiating $2 CPM with a single network, RTB exposes your inventory to hundreds of advertisers simultaneously. One advertiser might bid $0.80 for a standard user, while another bids $3.50 for a user matching precise targeting criteria. You automatically capture the higher bid.

The process flow runs invisibly: user opens app → SSP sends banner request → exchange initiates auction → multiple DSPs evaluate and bid → highest bidder wins → ad renders → impression tracked → revenue credited. Publishers see only the result – filled banner placements and eCPM reports.

How banner ads work in mobile apps

Banner ads implement auto-refresh capabilities, cycling new creatives every 30-60 seconds to multiply impression volume from a single placement. One banner position with 45-second refresh generates 80 impressions per hour versus one static impression, transforming $0.68 eCPM into $54.40 hourly revenue per placement.

The technical flow starts when your app sends an ad request to your programmatic partner. Real-time bidding runs its auction, the ad creative renders, viewability tracking begins, and once the impression meets IAB standards, it counts toward your revenue.

Yango Ads Ad Network for banner ad monetization

Yango Ads Ad Network specializes in mobile banner ad optimization through programmatic demand, connecting US publishers to global advertiser demand via real-time bidding infrastructure. The platform supports all IAB standard banner sizes – 320×50, 300×250 MREC, 728×90, and 320×100 – with separate bidding optimization for iOS and Android to capture platform-specific eCPM differentials.

Beyond banners, the network provides interstitial ads, rewarded video, native mobile ads, app open ads, and feed ads – enabling publishers to implement hybrid monetization strategies with banners as the consistent baseline revenue layer. Technical capabilities include programmatic RTB, built-in A/B testing for banner placements, comprehensive analytics dashboards tracking eCPM by placement and geography, and full GDPR and CCPA compliance with automated consent management.

For app developers: maximizing banner ad revenue

Why choose banner ads

App developers choose banner ads for three compelling reasons: consistent revenue regardless of user engagement levels, minimal disruption preserves retention metrics and session length, and universal compatibility works across all app categories.

The "fill rate" advantage directly translates to revenue reliability. Rewarded video fills 60-80% of requests, leaving 20-40% of monetization opportunities empty. Banners fill 90%+, capturing revenue from nearly every session. Advertiser demand for banners remains strong because the format costs 20% less than native ads while delivering similar reach opportunities. User churn risk stays minimal because banners don't interrupt core app functionality.

Format selection and refresh optimization

MREC 300×250 format delivers 30-50% higher performance than 320×50 leaderboards due to superior viewability and creative canvas size. Refresh intervals between 30-60 seconds optimize the balance between impression volume and user experience. Thirty-second refresh generates 120 impressions per hour from a single placement versus one static impression, multiplying revenue by 120x.

The math works like this: one banner at $0.68 eCPM with 45-second refresh generates 80 impressions hourly, or $54.40 per hour. Three banner placements with strategic refresh triple that baseline. Platform focus matters because Android's $0.68 eCPM versus iOS's $0.27 creates a 150% revenue differential for identical traffic volumes.

A/B testing identifies optimal configurations for your specific user behavior. Test MREC versus leaderboard formats, try different refresh rates, compare placement positions, and measure both eCPM changes and retention impact.

For advertisers: leveraging banner ad reach

Campaign objectives and creative best practices

Advertisers buying banner inventory through programmatic RTB access massive reach with cost efficiency – typical CPMs under $3 deliver thousands of impressions for modest budgets. Campaign objectives suited to banners include sustained visibility building, user acquisition at scale, retargeting campaigns, and geographic targeting. The 20% cost advantage versus native ads means advertisers stretch budgets further.

Programmatic buying happens through DSPs running millisecond auctions, targeting users via demographic, geographic, behavioral, and contextual signals. Creative best practices focus on clear calls to action, high-contrast imagery, minimal text (5-10 words maximum), prominent logo placement, and file sizes under 150KB meeting IAB standards.

Campaign use cases where banners excel include sustained visibility through persistent presence, retargeting website visitors with 20% cost savings versus richer formats, user acquisition campaigns prioritizing volume, and local business advertising targeting specific geographic markets. Publishers benefit when advertisers optimize creative because better-performing ads generate higher engagement metrics, which improve inventory quality scores and attract increased demand at premium CPMs.

Privacy & compliance requirements

GDPR and CCPA compliance for banner ads

GDPR governs banner advertising for EU residents globally, requiring explicit opt-in consent before collecting personal data or serving targeted ads. Penalties reach €20 million or 4% of annual revenue for violations. Publishers must implement consent management platforms collecting explicit permission, honor user rights to access and delete data, and maintain transparent privacy policies.

CCPA applies to California residents and businesses meeting revenue or data volume thresholds, using an opt-out model rather than opt-in. Penalties reach $7,500 for intentional violations and $2,500 for unintentional ones. Requirements include prominent notice of data collection, functional opt-out mechanisms, user rights to request deletion, and non-discrimination policies.

COPPA protects children under 13 in the US, requiring verifiable parental consent before collecting data from minors. The opt-in versus opt-out distinction creates different user experiences: GDPR requires asking permission before any tracking, while CCPA allows tracking by default with a clear path to opt out. Implementation requires consent management platforms, privacy policy templates, preference tracking systems, and modified targeting strategies for users declining personalized ads.

Banner ads in gaming apps

Gaming apps position banner ads at bottom anchors during active gameplay, MREC placements in pause menus and level selection screens, and inline banners during loading screens. This strategic placement maintains visibility while avoiding interface conflicts with gameplay controls. The hybrid approach combines banners' 90%+ fill baseline with rewarded video for engaged players and interstitials at level transitions.

Revenue calculations for a casual gaming app with 10,000 daily active users: three impressions per user daily at $0.68 eCPM produces 30,000 daily impressions, earning $20.40 daily or $612 monthly from banner baseline. The hybrid strategy – banners for baseline plus premium formats for engaged users – protects against over-monetization while capturing maximum value.

Implementation best practices

Analytics and performance monitoring

Analytics platforms track key banner metrics including eCPM by placement, format, and geography, fill rates across demand partners, impressions per session, revenue per daily active user, and click-through rates. Real-time reporting enables quick identification of performance anomalies.

A/B testing identifies optimal configurations by comparing MREC versus leaderboard performance, testing different refresh intervals, evaluating placement positions, and measuring demand partner configurations. Benchmarking validates performance against industry standards. Behind every impression lies a data story — and Yango Ads Ad Network helps publishers read it, turning insight into measurable revenue gains.

The bottom line

Mobile banner ads provide the foundational layer for app monetization strategies, delivering 90%+ fill rates and consistent eCPMs that create predictable revenue streams. Android publishers capture $0.68 eCPM in the US during Q4 2024, while iOS generates $0.27 – rates that multiply into substantial monthly revenue through high impression volumes from strategic placement and refresh optimization.

Programmatic infrastructure powers banner monetization through real-time bidding, so every impression reaches market value. Publishers combining banners with premium formats create hybrid strategies that maximize total revenue while managing user experience impact. The opportunity lies in treating banner monetization as a sophisticated revenue discipline – test formats, optimize placements, monitor analytics, and continuously refine configurations based on data.

Ready to optimize your banner strategy?

Frequently asked questions

Do banner ads work better on iOS or Android?

Android banner ads significantly outperform iOS, generating $0.68 eCPM versus $0.27 in the US market during Q4 2024 – approximately 150% higher rates for Android, making Android traffic more valuable for banner-focused monetization strategies.

How do I implement banner ads without hurting user experience?

Strategic placement preserves user experience: position banners at screen edges avoiding core functionality, use MREC formats in natural content breaks, implement 30-60 second refresh intervals, and monitor retention metrics alongside revenue to make sure monetization doesn't degrade engagement.

How can I use banner ads with other ad formats?

Hybrid strategies combining banners with interstitials, rewarded video, and native ads maximize total revenue. Use banners for consistent baseline monetization (90%+ fill), layer interstitials at transition points, and offer rewarded video to engaged users – this approach captures value from different user segments without over-relying on disruptive formats.